9 Easy Facts About Public Adjuster Explained

Wiki Article

Some Ideas on Public Adjuster You Need To Know

Table of ContentsPublic Adjuster - An OverviewThe Buzz on Public AdjusterSee This Report about Property Damage

A public insurance adjuster is an independent insurance coverage professional that an insurance policy holder might employ to aid settle an insurance policy claim on his/her behalf. Your insurance coverage firm gives an insurance adjuster at on the house to you, while a public adjuster has no partnership with your insurer, and charges a cost of as much as 15 percent of the insurance policy negotiation for his or her services.

If you're considering employing a public adjuster: of any type of public insurer. Request for recommendations from family members and affiliates - property damage. Ensure the insurer is licensed in the state where your loss has actually occurred, and call the Better Organization Bureau and/or your state insurance policy department to examine up on his/her record.

Your state's insurance division may set the percentage that public insurance adjusters are allowed charge. Watch out for public adjusters who go from door-to-door after a catastrophe. property damage.

Financial savings Contrast prices and also minimize home insurance policy today! When you sue, your homeowners insurance provider will appoint a cases adjuster to you. The insurance adjuster's task is to review your residential property damage as well as determine a reasonable payment quantity based on the levels of insurance coverage you carry on your policy.

The Loss Adjuster Statements

Like a claims adjuster, a public adjuster will certainly examine the damages to your building, aid establish the scope of repairs and also estimate the substitute value for those repairs. The huge difference is that rather than working with part of the insurance coverage firm like an insurance declares adjuster does, a public insurance claims insurer works for you.

The NAPIA Directory site provides every public adjusting firm required to be accredited in their state of operation (loss adjuster). You can enter your city and state or postal code to see a list of insurance adjusters in your location. The other means to find a public insurance policy adjuster is to obtain a suggestion from pals or family members.

Many public insurance adjusters keep a portion of the last case payment. If you are facing a large claim with a potentially high payout, factor in the price before selecting to employ a public insurance adjuster.

The Best Strategy To Use For Loss Adjuster

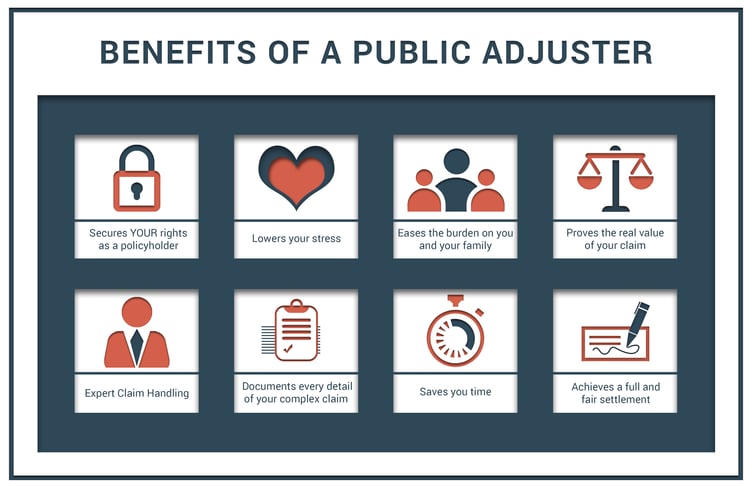

To attest to this dedication, public insurance adjusters are not compensated front. Instead, they get a percentage of the settlement that they acquire in your place, as managed by your state's department of insurance coverage. An experienced public insurance adjuster functions to complete several jobs: Understand and also evaluate your insurance coverage Maintain your civil liberties throughout your insurance coverage case Properly as well as extensively examine and also value the extent of the building damage Use all plan provisions Negotiate an optimized negotiation in a reliable as well as reliable fashion Functioning with click site a skilled index public insurance adjuster is just one of the very best methods to get a quick and also reasonable negotiation on your claim.

For that reason, your insurance provider's representatives are not necessarily mosting likely to look to discover every one of your losses, viewing as it isn't their obligation or in their benefit. Offered that your insurer has an expert working to protect its rate of interests, should not you do the same? A public adjuster can deal with several kinds of claims in your place: We're typically asked regarding when it makes good sense to hire a public claims adjuster.

Nonetheless, the bigger and also more intricate the claim, the most likely it is that you'll need specialist help. Working with a public adjuster can be the appropriate choice for several types of property insurance policy cases, particularly when the risks are high. Public insurance adjusters can assist with a number of important jobs when navigating your claim: Translating plan language and determining what is covered by your company Conducting a thorough analysis of your insurance plan Considering any kind of current changes in building ordinance as well as regulations that could supersede the language of your plan Finishing a forensic examination of the building damages, usually discovering damages that you could try this out can be otherwise difficult to discover Crafting a tailored plan for obtaining the most effective settlement from your home insurance coverage claim Recording and valuing the full level of your loss Assembling photographic proof to support your case Dealing with the everyday tasks that usually go along with suing, such as communicating with the insurance coverage firm, going to onsite conferences and also sending files Offering your cases package, including sustaining paperwork, to the insurer Skillfully discussing with your insurance coverage firm to make sure the biggest negotiation feasible The most effective component is, a public insurance claims insurance adjuster can obtain included at any kind of factor in the claim filing process, from the moment a loss takes place to after an insurance policy claim has actually currently been paid or rejected.

Report this wiki page